Global InsurTechs Market Overview:

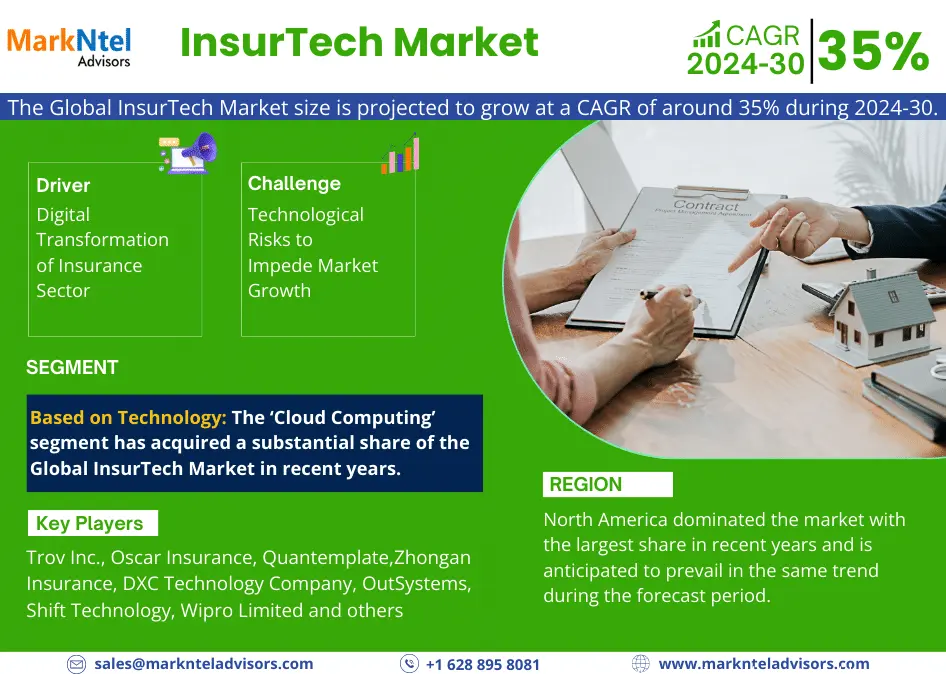

According to MarkNtel Advisors study the Global InsurTech Market size is projected to grow at a CAGR of around 35% during the forecast period, i.e., 2024-30. The market is driven principally by an increasing inclination of insurance companies toward digitalization to yield operational efficiency while providing services like faster claim processing, an automated claims process, enhanced coordination amongst parties, and improved communication platforms, among others, to their customers.

Global InsurTech Market Challenge:

Technological Risks to Impede Market Growth – Undoubtedly, technological hazards can provide obstacles for the Global InsurTech Industry. Technology is the engine of innovation in the insurance sector, but it also brings several dangers that require careful management. Cyberattacks target InsurTech companies because they manage enormous volumes of sensitive client data. Risks associated with data breaches, illegal access, and other cybersecurity issues can result in large-scale monetary losses, harm to one’s reputation, and legal repercussions.

Furthermore, it can be difficult to integrate and apply new technology to current systems. The innovative technologies that InsurTech companies hope to deploy may not be readily compatible with the insurance industry’s legacy systems. Delays, higher expenses, and interruptions to operations may result from this. Additionally, when it comes to software tools, cloud services, and data analytics platforms, among other technological solutions, InsurTech enterprises frequently depend on outside suppliers. Reliance on outside vendors exposes the InsurTech company to the danger of service interruptions, outages, or other problems that are not directly under its control. Therefore, all these factors may hinder the growth of the Global Insurtech Market in the coming years.

In case you missed it, we are currently revising our reports. Click on the “request sample report“ button to get the latest research data with forecast for the years 2025 to 2030, including market size, industry trends, and competitive analysis. It wouldn’t take long for the team to deliver the most recent version of the report.

Scope of the InsurTechs Market Report Segmentation

-By Technology

- Block chain

- Cloud Computing

- Internet of Things (IoT)

- Machine Learning (ML)

- Artificial Intelligence (AI)

- Drones

-By Deployment Mode

- On-Premise

- Cloud

-By Application

- Life and Accident Insurance

- Health and Medical Insurance

- P&C Insurance

- Commercial Insurance

- Insurance Administration and Risk Consulting

- Annuities

For more detailed information about the InsurTechs market report, click here – https://www.marknteladvisors.com/research-library/global-insurtech-market.html

Geographical analysis:

-By Region

- North America

- South America

- Europe

- Middle East & Africa

- Asia-Pacific

North America dominated the market with the largest share in recent years and is anticipated to prevail in the same trend during the forecast period. It owes principally to the escalating adoption of InsurTech solutions to upgrade the entire insurance sector with the latest technological solutions, coupled with the rising customer inclination toward online platforms to avail of insurance services.

Additionally, benefits like liquidity, price transparency, etc., and innovations in insurance services for clients are also aiding in the adoption of InsurTech solutions across North America and fueling overall market growth. Besides, the extensive presence & active participation of prominent players in the region and the mounting demand for end-to-end digital solutions are other crucial aspects expected to drive market growth across North America in the coming years.

Global InsurTech Industry Recent Development:

- In August 2023, DXC Technology Company, disclosed a new multi-year arrangement to provide end-to-end support for a component of AT&T’s IT infrastructure operations. AT&T’s midrange IT infrastructure, comprising enterprise compute, storage, backup, and recovery environments, will be managed by DXC. In addition, DXC will oversee the maintenance and design of the hardware in these settings, as well as the databases, storage, and systems.

Current Landscape of InsurTechs Market

The report delineates key market participants and thoroughly assesses their strategic approaches, trends, innovations, and manufacturing infrastructure, enabling a forecast of their market impact over the next five years. The meticulously researched data presented holds the potential to distinguish even nascent market entrants in the long term. Armed with pertinent data and actionable insights, our research report delivers a comprehensive overview of the market, empowering investors and stakeholders to establish a robust presence in the InsurTechs market. The research report profiles major players, including

Customization of Reports Available – https://www.marknteladvisors.com/query/request-customization/global-insurtech-market.html

- Trov, Inc.

- Oscar Insurance

- Policy Bazaar

- Quantemplate

- Clover Health Insurance

- Tractable

- Anorak Technologies

- Majesco

- Cytora Ltd.

- Zhongan Insurance

Related Reports

- http://search.yahoo.com/search?p=%22Luxury+Furniture+Market+Valued+at+Around+USD+27.65+Billion+in+2023%2C+Set+to+Reach+Around+USD+41.95+Billion+by+2030%22&ei=UTF-8

- http://www.bing.com/search?q=%22Luxury+Furniture+Market+Valued+at+Around+USD+27.65+Billion+in+2023%2C+Set+to+Reach+Around+USD+41.95+Billion+by+2030%22

- http://www.bing.com/news/search?q=%22Luxury+Furniture+Market+Valued+at+Around+USD+27.65+Billion+in+2023%2C+Set+to+Reach+Around+USD+41.95+Billion+by+2030%22

- http://www.ask.com/web?q=%22Luxury+Furniture+Market+Valued+at+Around+USD+27.65+Billion+in+2023%2C+Set+to+Reach+Around+USD+41.95+Billion+by+2030%22

- https://twitter.com/search/realtime?q=%22Luxury+Furniture+Market+Valued+at+Around+USD+27.65+Billion+in+2023%2C+Set+to+Reach+Around+USD+41.95+Billion+by+2030%22

Why choose MarkNtel?

MarkNtel Advisors is a leading market research company, consulting, & data analytics firm that provides an extensive range of strategic reports on diverse industry verticals. We deliver data to a substantial & varied client base, including multinational corporations, financial institutions, governments, & individuals, among others.

Our specialization in niche industries & emerging geographies allows our clients to formulate their strategies in a much more informed way and entail parameters like Go-to-Market (GTM), product development, feasibility analysis, project scoping, market segmentation, competitive benchmarking, market sizing & forecasting, & trend analysis, among others, for 14.8 diverse industrial verticals.

For Media Inquiries, Please Contact:

Call: +1 628 895 8081 | +91 120 4278433

Email: sales@marknteladvisors.com

Sales Office: 564 Prospect St, B9, New Haven, Connecticut, USA-06511

Corporate Office: Office No.109, H-159, Sector 63, Noida, Uttar Pradesh-201301, India